Key Takeaways

- AI market expected to reach $5 trillion between late 2033 and early 2034, based on current growth trajectories

- Multiple forecasts project AI valuations between $3.5T and $4.8T by 2033, with 29-30% compound annual growth rates

- Market value grew from $189-$390 billion in 2023-2025 to projected multi-trillion dollar valuations within a decade

- North America commands 33-36% of global market share, maintaining dominant position through 2025

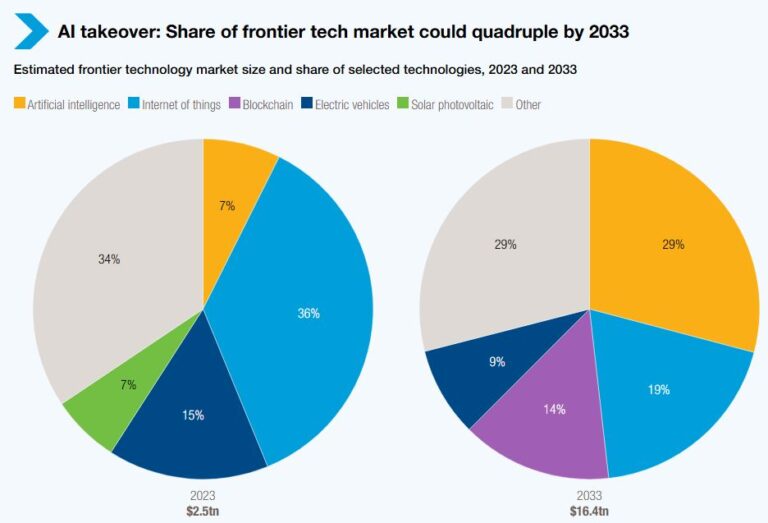

- AI’s share of frontier technology markets will quadruple from 7% to 29% by 2033, establishing dominance

- Software and services segments drive 70-80% of market revenue, with cloud deployment capturing 71% of implementations

- Healthcare, automotive, and operations functions lead AI adoption across enterprise sectors

AI Market Growth Trajectory Points to $5 Trillion by 2034

The artificial intelligence market stands positioned to cross the $5 trillion threshold between late 2033 and early 2034, marking an extraordinary transformation in technology economics. Current market valuations ranging from $233 billion to $391 billion in 2024-2025 face projected expansion to $3.5-$4.8 trillion by 2033, according to converging forecasts from UN Trade and Development (UNCTAD), Fortune Business Insights, and Grand View Research.

This timeline emerges from analyzing three distinct market projections that show remarkable consistency despite different baseline measurements. UNCTAD estimates the market will expand from $189 billion (2023) to $4.8 trillion by 2033. Fortune Business Insights projects growth from $294 billion (2025) to $1.77 trillion by 2032 at a 29.2% CAGR. Grand View Research forecasts expansion from $391 billion (2025) to $3.5 trillion by 2033 with a 30.6% CAGR. The mathematical convergence of these trajectories places the $5 trillion milestone within 12-18 months after 2033.

The 25-fold increase over ten years represents one of the fastest technology market expansions in economic history. AI’s ascension will establish it as the dominant force in frontier technologies, quadrupling its market share from 7% to 29% of the global technology sector by 2033.

Investment Dynamics Accelerating Market Expansion

Global investment patterns reveal the financial infrastructure propelling AI toward trillion-dollar valuations. Goldman Sachs projects worldwide AI investments reaching $200 billion by 2025, while individual technology companies command market capitalizations rivaling continental economies. Apple, Nvidia, and Microsoft each maintain valuations around $3 trillion, matching the GDP of Africa’s entire continent.

The United States funded 1,143 AI companies in 2024 from a global total of 2,049 funded ventures, demonstrating concentrated capital flows. This investment concentration creates dual effects: accelerating innovation within major economies while deepening global technological divides. Two countries—the United States and China—hold 60% of AI patents and produce one-third of global AI publications, with just 100 companies accounting for 40% of worldwide AI research and development spending in 2022.

Enterprise adoption statistics underscore commercial momentum driving market growth. IBM reports 42% of large enterprises actively implementing AI operations, while 35% of businesses have integrated AI technologies into core processes. SAP studies indicate small and medium enterprises anticipate 6-10% revenue increases through AI adoption, creating expansion opportunities across business scales.

Market Segmentation Reveals Growth Concentration

AI takeover: Share of frontier tech market could quadruple by 2033. Source: UN Trade and Development (UNCTAD) based on various online market research reports.

Note: Market size data capture the revenue generated by the sales of products and services. The graphs show the top four of 17 frontier technologies by market share for each year. The remaining 13 are grouped under “other”.

Component Analysis: Software and Services Dominance

Software solutions captured 34-48% of market revenue in 2024-2025, establishing the segment as the primary value driver. End-to-end AI platforms simplify model training for non-specialists, reducing hiring costs and accelerating development cycles. The software segment’s leadership stems from its critical role throughout AI workflow processes, from initial development through deployment and optimization.

Services represent the fastest-growing segment, projected to expand at a 32.1% CAGR through 2033. IBM, Accenture, PwC, TCS, and Capgemini report 2-3x growth in AI consulting demand from 2022 to 2024. Enterprise requirements for deployment expertise, customization, training, and maintenance drive service adoption as organizations lack internal AI capabilities. The services segment held 36.3% market share in 2025, positioned to capture increasing portions as AI complexity grows.

Hardware maintains steady demand supporting computational requirements, though representing a smaller revenue portion compared to software and services. Specialized components including GPUs, servers, sensors, and edge computing chips enable AI operations but face vulnerability to trade policies and tariff implementations affecting supply chains.

Deployment Models: Cloud Computing Captures Market

Cloud deployment dominates with 70.8% market share in 2025, expecting a 30.7% CAGR through the forecast period. The generative AI trend pushed organizations toward cloud solutions for scalable computing resources and development tools. Pandemic-driven digital transformation accelerated cloud adoption, establishing infrastructure that supports current AI expansion.

On-premise deployments maintain relevance for organizations operating under strict data sovereignty requirements. Geographic data residency regulations in multiple jurisdictions necessitate local infrastructure, sustaining on-premise market segments despite cloud dominance. This deployment model serves enterprises prioritizing data control and regulatory compliance over scalability benefits.

Enterprise Adoption Patterns and Functional Implementation

Large Enterprises Lead Implementation

Large enterprises captured 59.9% of market share in 2025, leveraging resources for comprehensive AI integration. These organizations implement AI across multiple business functions simultaneously, from financial management through product development. The 42% implementation rate among large enterprises, confirmed by IBM studies, demonstrates maturity in AI adoption strategies.

Small and medium enterprises exhibit the highest growth trajectory at a 32.1% CAGR, indicating democratization of AI access. Cost reductions in AI tools and platforms enable smaller organizations to compete through technology adoption. The performance improvements and revenue increases documented in SAP studies motivate SME investment despite resource constraints compared to large enterprises.

Functional Applications Driving Value

Service operations dominated functional implementation with 20-21% market share in 2025. AI minimizes service management workload while enhancing customer service speed and quality. BMC surveys show 69% of businesses implementing AI in IT service management and operations, pursuing operational efficiency improvements that deliver measurable cost reductions.

Risk management represents the fastest-growing function at a 32.4% CAGR, responding to multi-dimensional enterprise threats. Traditional risk systems operate reactively, while AI enables real-time predictive intelligence for fraud detection, breach prevention, regulatory compliance, climate impacts, and supply chain disruptions. Modern enterprises require sophisticated risk assessment capabilities that only AI-powered systems provide.

Sales and marketing functions demonstrate accelerated adoption rates, leveraging AI for lead analysis, customer data processing, and campaign personalization. Chatbots handle inquiries, qualify prospects, and schedule appointments, freeing human representatives for complex interactions. Marketing messages adapted through AI-driven demographic analysis and behavioral data improve targeting effectiveness and conversion rates.

Technology Foundations Enabling Market Growth

Deep Learning Establishes Technical Leadership

Deep learning technologies led the market with 25.3% revenue share in 2025, driven by complex data-driven applications in speech recognition, content analysis, and pattern identification. The technology overcomes high-data-volume challenges that constrained previous AI approaches. Research investments from major players continue advancing deep learning capabilities, expanding application possibilities across industries.

Machine vision exhibits the highest segment growth rate, propelled by 3D imaging technologies including stereo vision and structured lighting. Industrial operations increasingly deploy machine vision for inspection and measurement processes, replacing manual systems with automated solutions. Smart cameras and image processing systems deliver efficiency and reliability improvements that justify capital investments.

Quantum AI emerges as a transformative technology trend with potential to revolutionize multiple sectors. Quantum computing principles applied to AI algorithms enable rapid solutions for problems traditional computers struggle addressing. Applications span drug discovery, financial risk evaluation, climate modeling, and cybersecurity. Tech companies and governments invest heavily in quantum research, with partnerships like the July 2024 Zapata-D-Wave collaboration accelerating development of combined quantum and generative AI solutions.

Artificial Neural Networks Advance Capabilities

ANN (Artificial Neural Networks) progress fuels AI adoption across aerospace, healthcare, manufacturing, and automotive sectors. These networks recognize patterns and provide customized solutions, replacing conventional machine learning systems with more precise alternatives. Google Maps exemplifies ANN deployment for route optimization and feedback processing, demonstrating practical applications.

Computer vision advancements through GAN (Generative Adversarial Networks) and SSD (Single Shot MultiBox Detector) enable digital image processing techniques. Low-light or low-resolution imagery transforms to HD quality through these methods. Security, surveillance, healthcare, and transportation sectors build foundations on continuous computer vision research, altering how AI models train and deploy.

Industry-Specific Growth Drivers

Healthcare Dominates End-Use Applications

Healthcare secured the highest revenue share in 2025 among all industries, driven by diagnostic improvements, patient care enhancement, and operational efficiency gains. Machine learning and deep learning technologies enable sophisticated analysis of large medical datasets for personalized treatment planning. Applications in medical imaging, drug discovery, and predictive analytics deliver significant advancements in disease treatment approaches.

AI integration reduces medical errors, streamlines clinical workflows, and supports better decision-making processes. Hospitals and research institutions increasingly rely on AI systems to improve patient outcomes while controlling costs. The widespread adoption established healthcare as the dominant sector, with continued expansion expected as new applications emerge.

Automotive and Transportation Show Rapid Expansion

Autonomous vehicle demand and advanced driver-assistance systems (ADAS) drive AI adoption in automotive sectors. Technologies enhance traffic management, route optimization, and predictive maintenance, improving transportation efficiency. Machine learning and computer vision enable real-time object detection and safety monitoring across connected vehicle ecosystems.

AI processes massive data volumes from sensors and cameras, supporting smart logistics, fleet management, and mobility-as-a-service solutions. Government safety regulations worldwide accelerate implementation, as authorities enact strict measures addressing road safety concerns. The automotive sector emerges as a key growth area within the broader AI market.

Geographic Market Distribution and Concentration

North America Maintains Leadership Position

North America dominated the global market with 33-36% share in 2024-2025, sustaining the largest regional market presence. The United States led North American markets, benefiting from deep talent pools, established tech infrastructure, and concentrated research investments. Silicon Valley and major tech hubs provide ecosystem advantages that maintain competitive positioning.

The region’s advantage stems from early AI adoption, substantial venture capital availability, and proximity to leading technology companies. Universities and research institutions produce skilled workers meeting industry demands. This concentration creates network effects that reinforce regional dominance despite growing competition from other markets.

Asia Pacific Emerges as Fastest-Growing Region

Asia Pacific represents the fastest-growing regional market, driven by China’s substantial AI investments and adoption across multiple economies. Manufacturing sector concentration in Asia creates natural AI application opportunities for process optimization and quality control. Government initiatives supporting AI research and development accelerate regional growth trajectories.

The region faces challenges including talent distribution and infrastructure development across diverse economies. Developed markets like Japan, South Korea, and Singapore lead regional adoption, while developing nations work to establish AI capabilities. This growth disparity within Asia Pacific creates opportunities for technology transfer and market expansion as infrastructure improves.

Global Development Challenges and Opportunities

Concentration Risks Widening Technology Divides

AI development concentration in major economies risks deepening global disparities. Advanced economies benefit from deeper talent pools possessing required technical skills. By 2023, two-thirds of developed economies implemented national AI strategies compared to just 30% of developing countries. Among least developed countries, only 12% established AI strategies.

This strategic gap threatens to perpetuate economic divides as AI reshapes industries and employment. Developing nations require infrastructure upgrades ensuring equitable access to electricity, internet, and computing power. Open data promotion and sharing improve storage, access, and collaboration capabilities necessary for AI development.

Education and Skills Development Critical Path

Building AI literacy across populations through integrated STEM education from early schooling through lifelong learning programs represents essential infrastructure. Countries lacking educational foundations face sustained disadvantages as AI transforms job markets and economic opportunities. The technology’s borderless nature contrasts with fragmented governance dominated by wealthy nations.

Only G7 countries participate in all major AI governance initiatives, while 118 countries—mostly developing nations—remain uninvolved in any governance frameworks. This representation gap creates alarming disparities in setting standards, ethical guidelines, and development priorities affecting global AI deployment.

Employment Impacts and Workforce Transformation

AI affects 40% of jobs globally, with advanced economies facing higher automation risks than developing nations. Up to one-third of jobs in developed countries face automation potential, though these economies position themselves advantageously: 27% of their jobs could be enhanced by AI, boosting productivity and complementing human skills rather than replacing workers.

The employment transformation requires strategic workforce development addressing both displacement risks and enhancement opportunities. Industries from content creation through customer service experience AI integration, changing skill requirements and work processes. Organizations implementing AI for human agent assistance demonstrate how technology augments rather than replaces workers, handling repetitive tasks while enabling humans to focus on complex interactions.

Market Outlook and Strategic Implications

The path to $5 trillion valuation represents more than numerical growth—it signals AI’s establishment as the defining technology of the current era. The market’s 25-30% compound annual growth rates through 2033 position it among history’s fastest technology expansions. This trajectory depends on sustained investment, continued technological breakthroughs, and expanding application across industries and geographies.

Quantum AI, neuromorphic computing, and next-generation generative models stand at the forefront of coming advancements. Investment explosion in AI-driven automation, precision medicine, autonomous systems, and ethical governance will shape the next decade. Industry convergence intertwining AI with biotech, finance, and IoT will reshape entire business ecosystems.

Strategic cooperation among nations, corporations, and research institutions determines whether AI’s benefits distribute broadly or concentrate further. Inclusive governance frameworks putting people first become essential as the technology’s power grows. Multi-stakeholder cooperation aligning AI with global development goals ensures benefits reach beyond wealthy nations and large corporations.

The timeline to $5 trillion reflects not merely market forces but collective choices about technology development, deployment, and governance. Organizations and nations positioning themselves effectively within this transformation will shape the AI era’s economic and social outcomes, while those falling behind face widening disadvantages in an increasingly AI-driven global economy.

If you are interested in this topic, we suggest you check our articles:

- How to Identify and Stay Ahead of AI Trends?

- AI in the Finance Sector: Innovative Technology Use in Important Industries

Sources: UN Trade and Development, Fortune Business Insights, Grand View Research

Written by Alius Noreika