Key Takeaways

- Ozak AI has secured over $3.4 million in its ongoing presale, selling more than 916 million tokens across six funding stages

- The platform merges artificial intelligence with blockchain infrastructure through its DePIN model and Ozak Stream Network for real-time financial analytics

- Current token price sits at $0.012-$0.014, representing a 1,300% increase from the initial $0.001 launch price

- Analysts project potential returns of 40x to 100x by 2026, with target prices ranging from $0.50 to $1.20 per token

- Strategic partnerships include Perceptron Network (700,000+ nodes), SINT, Hive Intel, Pyth Network, and Weblume

- Platform combines AI-driven prediction models, decentralized storage, cross-chain compatibility, and CertiK security certification

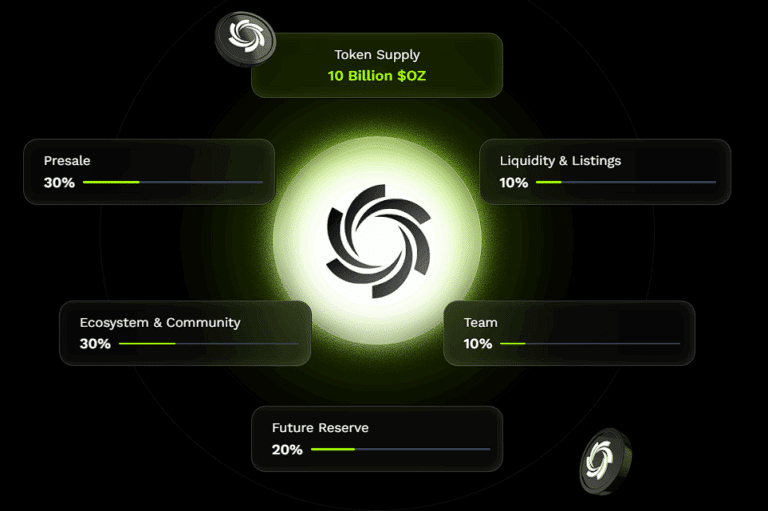

- Total token supply capped at 10 billion, with 3 billion allocated to presale phases

AI-Blockchain Fusion Commands Investor Attention

Ozak AI has emerged as a standout project in cryptocurrency markets, combining artificial intelligence capabilities with blockchain infrastructure to create what analysts describe as a potential paradigm shift in decentralized finance. The platform’s presale performance tells a compelling story: more than $3.4 million raised, nearly one billion tokens distributed, and whale investors accumulating substantial positions at current pricing levels.

The comparison to Ethereum’s formative years carries weight beyond superficial similarities. Where Ethereum introduced smart contracts and spawned entire industries around decentralized finance and non-fungible tokens, Ozak AI targets the intersection of AI and blockchain—a space many industry observers believe represents the next frontier of crypto innovation. Early Ethereum investors who purchased ETH below $10 witnessed returns that changed financial trajectories as prices climbed into thousands of dollars per token.

Technical Infrastructure Separates Hype from Substance

Ozak AI’s architecture centers on its Decentralized Physical Infrastructure Network (DePIN) model and the Ozak Stream Network (OSN). These systems enable autonomous data aggregation, real-time financial analysis resistant to tampering, and decentralized automation across blockchain networks. The platform supports cross-chain functionality, allowing it to operate across multiple blockchain ecosystems rather than remaining siloed within a single network.

The OZ token serves multiple functions within this ecosystem. Token holders can stake their holdings for rewards, participate in governance decisions that shape platform development, and access advanced features as the ecosystem expands. This utility-driven tokenomics model differs from speculative projects lacking clear use cases.

Security infrastructure includes CertiK certification, an audit standard that examines smart contract vulnerabilities and potential exploit vectors. Platform listings on CoinMarketCap and CoinGecko provide transparency for prospective investors evaluating market metrics and trading activity.

Partnership Network Builds Real-World Applications

Ozak AI’s collaboration with Perceptron Network represents a particularly significant milestone. Perceptron operates more than 700,000 active nodes, providing distributed computing power, bandwidth, and data resources essential for scaling AI systems. This partnership enables Ozak AI to develop prediction agents and trust-based reward mechanisms—practical applications that extend beyond theoretical white papers.

Additional strategic alliances strengthen different platform components. SINT integration adds voice recognition and autonomous market signal execution, serving a user base exceeding 60,000 traders. Hive Intel contributes live blockchain data feeds for trading bot functionality. Weblume allows Web3 developers to embed Ozak AI indicators into no-code dashboards without requiring extensive technical expertise. Pyth Network delivers real-time financial data streams, while Dex3 provides decentralized trading infrastructure.

These partnerships address a critical weakness in many blockchain projects: the gap between ambitious vision statements and functional product delivery. Ozak AI’s operational Rewards Hub already offers staking opportunities and ecosystem incentives, demonstrating working infrastructure rather than vaporware promises.

Presale Economics Present Asymmetric Risk-Reward Profile

At the current Stage 6 price of $0.012 per token, a $500 investment secures approximately 41,666 OZ tokens. A $1,000 commitment purchases roughly 83,333 tokens. If analyst forecasts proving accurate and OZ reaches $1.20 by 2026, these positions would appreciate to $50,000 and $100,000 respectively—the frequently cited 100x return that drives early-stage crypto investing.

Even conservative milestone projections illustrate significant upside potential. Should OZ reach $0.10, a $1,000 investment grows to $8,333. At $0.50, that same position exceeds $41,000 in value. The token launched at $0.001 and has progressed through six presale stages, with Stage 7 projected at $0.016—a 1,300% increase from initial pricing.

This presale structure creates tiered entry points, with earlier participants securing lower prices before exchange listings typically drive price discovery based on open market dynamics. The allocation of 3 billion tokens to presale stages out of a 10 billion total supply establishes scarcity mechanics while ensuring sufficient liquidity for future trading.

Whale Accumulation Signals Institutional Confidence

Large wallet holders—industry insiders refer to them as “whales”—have reportedly begun accumulating millions of OZ tokens during presale phases. This pattern historically validates projects with substantial growth potential, as sophisticated investors with extensive due diligence resources commit capital based on fundamental analysis rather than speculative momentum.

Whale participation creates secondary effects beyond simple validation. As large buyers absorb available supply, remaining tokens become scarcer for retail investors seeking substantial allocations. Each presale stage increases token prices incrementally, compressing the window for optimal entry pricing before eventual exchange listings expose the token to broader market forces.

This accumulation dynamic differs markedly from projects where token distribution remains diffuse or concentrated among team members and early insiders. Third-party whale interest suggests external validators have examined Ozak AI’s technology, partnerships, and roadmap before committing significant resources.

Global Expansion Through Community Engagement

Ozak AI’s presence at Coinfest Asia 2025 in Bali marked a strategic milestone in international outreach. The August event facilitated networking with partners including Manta Network, Forum Crypto Indonesia, and Coin Kami through hosted mixers and community gatherings. These face-to-face engagements build relationships that purely digital projects struggle to establish.

Regional initiatives extended beyond single conferences. The Sundown Signals series, dedicated Ozak AI Roadshow, and Vietnam networking events with SoulsLabs, MPost.io, and Yellow demonstrate systematic geographic expansion. This ground-level approach to community building creates regional advocates who drive adoption within local crypto ecosystems.

Physical presence at industry events provides intangible benefits that online marketing cannot replicate. Attendees evaluate team credibility, ask technical questions directly to developers, and form personal connections that influence investment decisions and project support.

The Billion-Dollar Market Cap Trajectory

Ozak AI has publicly targeted a $1 billion market capitalization, positioning this milestone as a realistic near-term objective rather than speculative fantasy. With a bottom-end target price of $1.00 per token and 10 billion tokens in total supply, reaching this valuation would require sustained adoption, partnership execution, and broader market conditions supportive of AI-blockchain convergence projects.

Current cryptocurrency market dynamics show increased institutional interest in AI-related tokens, driven by mainstream artificial intelligence breakthroughs and growing recognition that blockchain infrastructure offers unique advantages for AI model training, data verification, and decentralized compute resources. Ozak AI enters this landscape with functional technology and established partnerships rather than purely conceptual positioning.

The roadmap execution will ultimately determine whether ambitious targets translate into realized valuations. Projects achieving product-market fit and demonstrating revenue-generating use cases typically see sustained price appreciation divorced from general market sentiment. Ozak AI’s focus on predictive analytics and actionable financial insights positions it within a tangible market rather than abstract technological possibilities.

Risk Factors and Market Realities

Despite compelling fundamentals and ambitious projections, prospective investors should recognize inherent risks in early-stage cryptocurrency projects. Regulatory uncertainty continues affecting blockchain ventures globally, with different jurisdictions implementing varying frameworks that can impact token utility and exchange availability. Market volatility remains extreme in cryptocurrency sectors, where sentiment shifts can override fundamental analysis.

Technology execution risk persists regardless of partnership quality or presale success. Scaling AI systems across decentralized networks presents complex technical challenges, and competitors with greater resources may develop superior solutions. Token price predictions, while based on analyst models, cannot account for unforeseen market disruptions or changes in broader economic conditions affecting risk asset appetite.

The comparison to Ethereum, while illustrative, should not imply guaranteed outcomes. Many projects positioned as “the next Ethereum” have failed to achieve meaningful adoption despite strong initial momentum. Due diligence remains essential, including examination of team backgrounds, technical documentation, audit reports, and competitive positioning within the AI-blockchain landscape.

Investment Implications and Strategic Considerations

For investors who missed early entry into Ethereum below $10 or Solana under $1, Ozak AI presents a calculated opportunity to participate in what may become a defining project of the next cryptocurrency cycle. The combination of working infrastructure, strategic partnerships, whale accumulation, and presale momentum mirrors patterns observed in successful historical projects.

The platform’s focus on practical applications—predictive analytics, automated decision systems, real-time data verification—addresses genuine market needs rather than creating solutions seeking problems. This product-market alignment, combined with the broader trend toward AI integration across industries, suggests Ozak AI has positioned itself within a growth sector rather than a speculative niche.

Current presale pricing offers asymmetric risk-reward profiles where modest capital commitments could generate substantial returns if adoption trajectories materialize as forecasted. The structured presale approach with incremental price increases rewards earlier participants while maintaining accessibility for those conducting thorough research before committing funds.

Conclusion: Monitoring an Emerging Contender

Ozak AI has assembled several elements that characterize projects with breakout potential: innovative technology combining trending sectors, strategic partnerships providing real-world utility, growing capital inflows demonstrating market interest, and ambitious yet plausible growth targets. Whether it achieves Ethereum-level impact remains speculative, but current indicators suggest this project merits serious attention from investors seeking exposure to AI-blockchain convergence.

The presale window represents a finite opportunity. As stages progress and token prices increase toward eventual exchange listings, entry points become less favorable. For those willing to accept early-stage project risks in pursuit of exponential returns, Ozak AI’s current phase offers access before mainstream discovery typically compresses upside potential.

Investors should conduct independent research, review available technical documentation and audit reports, assess their personal risk tolerance, and consider position sizing appropriate for speculative ventures. The next several months will prove critical as Ozak AI transitions from presale phases toward broader market exposure and continued partnership execution.

If you are interested in this topic, we suggest you check our articles:

Source: GlobeNewsWire

Written by Alius Noreika