Key Takeaways

- Silicon remains the fundamental material for AI chip substrates, refined from ultra-pure silica sand into wafers that form the base for billions of transistors

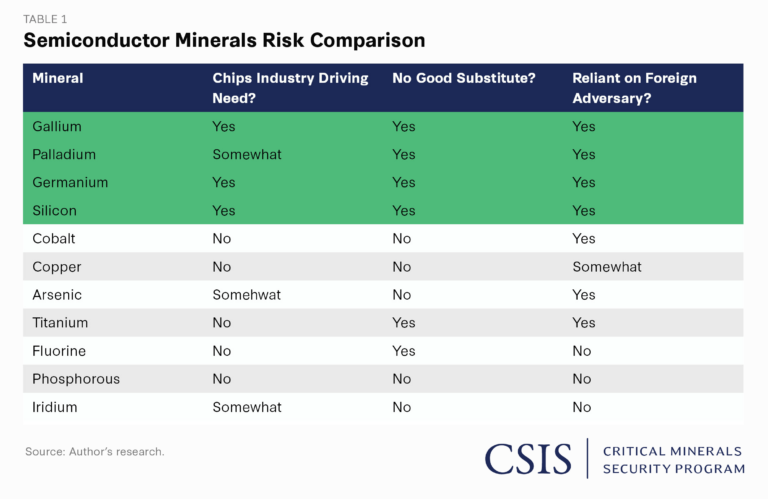

- Critical trace elements include gallium and germanium, essential for high-performance computing and high-speed data transmission with limited global supply outside China

- Copper serves as the primary conductor in chip interconnects and data center infrastructure due to superior electrical conductivity

- Rare earth elements like neodymium, europium, and dysprosium enable magnets, phosphors, and specialized semiconductors crucial for AI systems

- Dopants including boron, phosphorus, and arsenic modify silicon’s electrical properties to create functional transistors and circuits

- Palladium and tungsten provide durability in connections and high-temperature applications within chip architecture

- China controls 79% of raw silicon production and dominates gallium (98%) and germanium (60%) refining, creating significant supply chain vulnerabilities

Silicon: The Foundation of AI Chips

Silicon forms the bedrock of semiconductor manufacturing. Extracted from quartzite and silica sand deposits—where it ranks as Earth’s second-most abundant element after carbon—silicon undergoes extensive purification to achieve the ultra-high purity levels required for electronics. Manufacturers process this refined silicon into cylindrical ingots, then slice these into thin wafers measuring 300mm (12 inches) in diameter for advanced AI chip production.

The material’s semiconducting properties allow precise engineering at nanoscale dimensions. Silicon wafers serve as substrates onto which chip designers build billions of transistors and integrated circuits. China produces approximately 79% of global raw silicon, though the material requires additional processing into polysilicon at purity levels exceeding 99.999% for semiconductor applications. Japan and South Korea handle most silicon wafer manufacturing, but supply chains remain concentrated in East Asia.

Dopants: Controlling Electrical Properties

AI chip manufacturing depends on introducing specific impurities into silicon to control how electricity flows through transistors. This doping process uses three primary elements:

Boron creates p-type semiconductors by introducing positive charge carriers into silicon’s crystal lattice. These “holes” enable manufacturers to control current flow in logic and memory circuits.

Phosphorus produces n-type semiconductors by adding extra electrons to silicon’s structure. Combined with boron, phosphorus establishes alternating p-n junctions necessary for creating functional transistors.

Arsenic offers greater thermal stability compared to phosphorus, making it suitable for advanced chip designs operating under high voltage or temperature conditions. The element enables fine control over electrical conductivity in complex circuitry.

Critical Trace Elements for Performance

Gallium: High-Performance Computing

Gallium enables the production of gallium nitride (GaN) and gallium arsenide (GaAs) semiconductors that outperform silicon in high-frequency and high-power applications. These compounds deliver higher speed, lower resistance, and improved efficiency for AI hardware, 5G infrastructure, and power electronics.

The element appears in Earth’s crust at less than 19 parts per million and emerges only as a byproduct of bauxite mining. China produces 98% of refined gallium globally. Following export restrictions in August 2023, this concentration created alarm throughout the semiconductor industry. Western mining companies extract significant bauxite in Australia and Guinea, but China handles nearly all refining operations.

Germanium: Speed and Connectivity

Germanium’s superior electron mobility compared to silicon enables faster signal transmission in high-speed integrated circuits. The material proves essential for fiber-optic technologies supporting AI data centers, accounting for one-third of germanium demand. Infrared detectors, communication systems, and radar also rely on germanium wafers.

At just 1.5 parts per million in Earth’s crust, germanium ranks among the rarest metals. Production comes exclusively from zinc ore processing byproducts. China controls 60% of global germanium refining, with prices climbing over 70% to $2,280 per kilogram after export restrictions. Achieving the required purity levels above 99.999% demands expensive, technically challenging, and energy-intensive refining processes.

Metals for Interconnects and Durability

Copper: The Primary Conductor

Copper’s excellent electrical conductivity and low resistance make it the standard material for intricate wiring inside microchips. The metal allows signals and power to travel quickly and efficiently between components. NVIDIA and other AI hardware manufacturers increasingly favor copper for short-distance data transmission in AI data centers, where it consumes less power than fiber optics over short ranges.

Beyond chip internals, copper supports data center infrastructure through power transmission systems and cooling mechanisms. Its cost-effectiveness and performance balance makes it indispensable for energy-efficient AI devices.

Palladium: Connections and Stability

Palladium forms metal connections attaching chips to circuit boards and provides protective plating on semiconductors. The element’s exceptional corrosion and oxidation resistance ensures long-term reliability as chips become increasingly compact. Russia produces over 40% of global palladium from just two major projects, with South Africa contributing 34%. The United States imports significant quantities despite domestic production representing just 16% of consumption.

Tungsten and Molybdenum: High-Temperature Performance

Tungsten’s exceptional heat resistance enables its use in transistors and chip interconnects where high temperatures occur. The material withstands extreme conditions in power devices and densely packed semiconductor structures. Molybdenum emerges as a superior alternative for advanced nanoscale manufacturing, offering better performance characteristics than tungsten in next-generation chip architectures.

Rare Earth Elements: Specialized Functions

Neodymium: Magnetic Solutions

Neodymium forms the core of neodymium-iron-boron (NdFeB) permanent magnets used in hard disk drive spindle motors and data center cooling systems. These powerful magnets enable precise, high-speed rotation in storage devices and maintain optimal temperatures in AI computing facilities. Combined with praseodymium, neodymium magnets deliver enhanced strength and temperature tolerance.

Europium and Terbium: Display Technologies

Europium produces red phosphors essential for screens, LED displays, and full-color rendering in AI-integrated visual systems. The element also serves as a dopant in gallium nitride and indium phosphide semiconductors, enhancing optoelectronic properties.

Terbium provides green phosphor material for displays and contributes to high-k oxides used in semiconductor devices. These materials enhance stability and efficiency in memory and logic operations, supporting further chip miniaturization without sacrificing electrical performance.

Dysprosium and Samarium: Thermal Stability

Dysprosium increases resistance to demagnetization at high temperatures when added to NdFeB magnets, critical for data storage applications where thermal fluctuations could compromise reliability. Samarium-cobalt (SmCo) magnets offer exceptional thermal stability for mission-critical and defense-grade systems operating under extreme temperatures.

Additional Essential Materials

Cobalt enhances metallization processes in semiconductor manufacturing, forming reliable interconnects in logic and memory chips. The metal provides better resistance to electromigration in advanced semiconductor nodes.

Nickel creates anticorrosive coatings for connectors and battery terminals. Its conductivity and oxidation resistance maintain reliable electrical pathways in consumer and industrial electronic systems.

Silver delivers the highest electrical conductivity among metals, used in soldering materials, electrical contacts, and high-performance circuit boards where minimal resistance proves critical.

Gold provides excellent conductivity and unmatched corrosion resistance for bonding wires, connectors, and contact pads in chip packaging. The metal ensures long-term reliability in high-value electronic components.

Platinum enables production of high-purity glass and crucibles required during memory chip fabrication. Its high melting point and chemical stability prove critical for semiconductor-grade materials.

Indium forms indium tin oxide (ITO), a transparent conductive film for touchscreens and displays. The element also supports optical communication systems through transceivers and specialized coatings.

Specialized Gases and Processing Materials

Noble Gases for Manufacturing

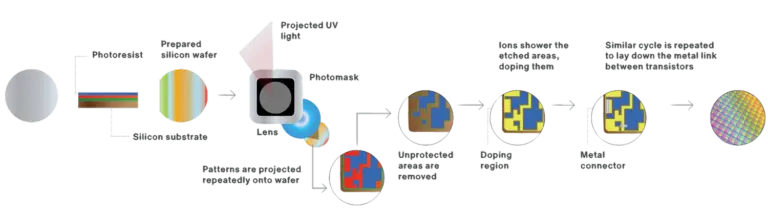

Neon enables excimer lasers during photolithography, the foundational step projecting circuit patterns onto silicon wafers. The semiconductor sector accounts for the vast majority of global neon demand, particularly crucial for producing high-density AI chips.

Helium creates inert environments during semiconductor processing and serves as a coolant in high-precision applications. Its chemical inertness and thermal conductivity prevent contamination while maintaining temperature control during etching and deposition.

Krypton and xenon support specialized processes including dry etching, rapid thermal annealing, and thin-film deposition. Their heavier atomic weights enable more precise material removal at nanoscale dimensions.

Chemical Processing Materials

Graphite dominates as the anode material in lithium-ion batteries powering portable electronics and backup systems for data centers. Advanced derivatives like graphene show promise in high-speed electronics and thermal management systems due to exceptional conductivity.

Lithium provides the foundation for rechargeable batteries supporting AI-integrated edge devices and ensuring continuous power to storage systems in data centers.

Manganese and cobalt contribute to various lithium-ion battery chemistries, enabling thermal stability and high energy density crucial for AI systems demanding reliable performance.

Supply Chain Vulnerabilities

Firms are building increasingly large supercomputers, containing more, and more performant, AI chips. Image credit: Epoch.ai

Geographic concentration creates significant risks in critical mineral supply chains. China controls production and refining of multiple essential materials:

- 79% of raw silicon production and 75% of ultra-high-purity polysilicon

- 98% of refined gallium

- 60% of germanium refining capacity

- Dominant position in rare earth element processing

Russia produces over 40% of global palladium, with limited alternative sources available. The United States produces minimal quantities of gallium (none), germanium (less than 2%), and palladium (5%), creating dependence on imports from strategic competitors.

Western mining companies operate significant bauxite mines in Australia and Guinea, zinc operations in Peru and Australia, and palladium projects in South Africa. However, China handles most refining operations, controlling midstream processing even when Western companies extract raw materials.

Manufacturing Process Requirements

AI chip production demands materials at multiple manufacturing stages. During design and fabrication, specialized chemicals coat wafers as photoresists, enabling circuitry patterns through photolithography. Chemical mechanical planarization (CMP) uses specialized slurries to remove excess material. Ion implantation introduces dopants into specific regions, while etching chemicals remove unwanted material.

Advanced packaging techniques increasingly drive semiconductor progress. Through-silicon vias (TSVs) connect vertically stacked dies using copper or tungsten. High-bandwidth memory essential for AI accelerators requires TSV technology. Chip-on-Wafer-on-Substrate (CoWoS) packaging stacks chiplets using interposer technology, employed in NVIDIA H100 chips combining GPUs with six high-bandwidth memory chiplets.

Economic and Strategic Implications

Material requirements translate directly into production costs and supply security. The U.S. Geological Survey estimates that a 30% supply disruption of gallium alone could trigger a $602 billion decline in economic output—equivalent to 2.1% of GDP. Export restrictions and supply disruptions already impact semiconductor manufacturing, with germanium prices climbing over 70% following Chinese export controls.

Refining infrastructure presents particular challenges. Achieving purity levels exceeding 99.999% requires expensive, technically demanding, and energy-intensive processes. China maintains competitive advantages through reduced environmental standards and government subsidies, making Western companies struggle to compete without financial incentives offsetting higher labor and power costs.

The semiconductor industry consumed an estimated 1.5 to 2 million NVIDIA H100 chips in 2024—a threefold increase over 2023. As AI systems scale, material demands intensify. OpenAI’s GPT-3 trained on approximately 10,000 chips, while GPT-4 reportedly used 25,000 chips, and future supercomputers plan deployments exceeding 400,000 advanced chips.

Future Material Considerations for AI Chip Manufacturing

Research explores alternative semiconductor materials including gallium nitride, graphene, and pyrite to diversify supply chains and improve performance. Investment in new semiconductor factories and production lines aims to reduce geographic concentration risks.

Computational performance of AI chips doubles approximately every 28 months, driving continuous material innovation. Advanced nodes require increasingly sophisticated materials meeting tighter specifications. As chips shrink and transistor counts grow, material purity and processing precision become more critical.

If you are interested in this topic, we suggest you check our articles:

- AI-Powered Supercomputers: Advancing Technology and Innovation

- AI’s Growing Demands Drive a New Era in Chip Design

- Microsoft’s Microfluidic Chip Cooling: A Radical Solution to AI’s Heat Crisis

Sources: SFA Oxford, IAPS, TechTarget, CSIS

Written by Alius Noreika