Key Takeaways

- The GenAI model market grew 149.8% in 2025, surpassing $14 billion, with projections showing 38% annual growth through 2028

- Over 250 foundation models now exist, with one-third launched since August 2023, demonstrating explosive market expansion, and still rapidly growing

- Microsoft, Amazon, and Google control critical infrastructure—10 of 12 major GenAI startups depend on their cloud services

- Nvidia dominates AI chip design with 80-95% market share, creating supply chain bottlenecks across the industry

- First-mover advantages disappear within 36 months as GenAI capabilities become baseline requirements

- Venture capital investment surged nearly fivefold to €20 billion in 2023, enabling rapid startup growth

- By 2026, more software spending will go toward GenAI-enabled products than traditional software

- Thirteen GenAI firms achieved unicorn status, with OpenAI leading while European startup Mistral established itself as a formidable competitor

The Stakes: A $14 Billion Market Transforming Global Economics

The generative AI model race represents more than technological innovation—it’s an economic transformation projected to boost global GDP by 7% over the next decade. With the GenAI models market exceeding $14 billion in 2025 and annual growth rates reaching 149.8%, tech giants and startups face unprecedented pressure to capture market share before competitive advantages evaporate.

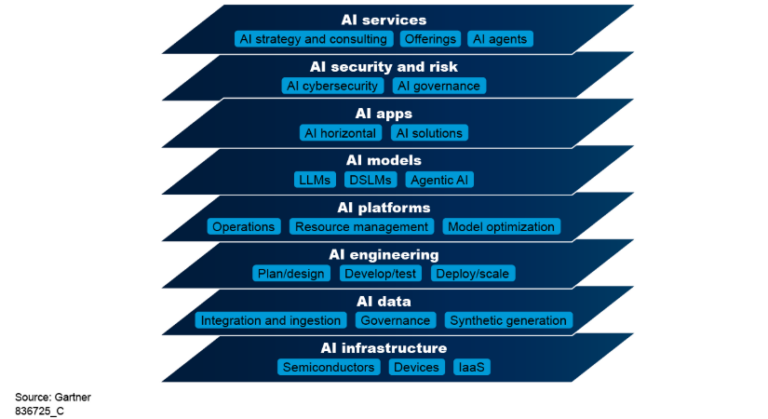

This competition unfolds across multiple dimensions simultaneously. Companies battle for technological superiority, infrastructure control, talent acquisition, and enterprise adoption. The winner won’t simply build the best model—they’ll dominate the entire value chain from specialized chips to end-user applications.

Market Dynamics: Speed Eliminates First-Mover Advantage

Traditional technology cycles allowed early innovators years to establish dominance. The GenAI race operates differently. Advantages erode within 36 months, forcing continuous innovation as a survival requirement rather than a competitive edge.

Every software market already passed the first-mover advantage threshold. New models emerge weekly, matching or exceeding existing capabilities. Stanford University’s foundation model database tracks this explosive growth—more than 250 models exist, with one-third launched since August 2023 alone.

The pace creates paradoxical pressure: companies must invest billions in research and infrastructure while knowing their technological lead will vanish in months. Less than one in five GenAI projects achieve desired business value through 2026, making practical application more critical than benchmark performance.

Major Competitors and Their Strategies

Microsoft: Infrastructure Integration Leader

Microsoft leveraged its OpenAI partnership to embed GPT technology throughout the Microsoft 365 suite under the Copilot brand. Azure OpenAI Service provides enterprise clients customizable access to foundational models, while partnerships with Nvidia bring cutting-edge GPU capabilities to Azure’s cloud platform.

The strategy extends beyond hosting. Microsoft rushed to offer Deepseek’s models despite direct competition with partner OpenAI, recently added xAI’s models, and maintains commercial partnerships requiring multi-year commitments to Azure infrastructure. This approach treats GenAI as a platform expansion tool rather than standalone business.

Google: Vertical Integration Through Partnerships

Google invested heavily in Anthropic, integrating Claude models into Google Cloud offerings to strengthen enterprise AI capabilities. Internal development produced Gemini (formerly Bard), competing directly with Microsoft’s solutions while partnerships with SAP and Salesforce enable seamless enterprise ecosystem integration.

The company’s AI expertise spans decades, providing advantages in model training efficiency and deployment scale. Google Workspace incorporates AI features across its productivity tools, though the company trails Microsoft in enterprise adoption momentum.

Amazon AWS: The Flexible Marketplace

Amazon’s Bedrock service positions AWS as the GenAI marketplace, offering models from Anthropic, Stability AI, and Cohere alongside Amazon’s proprietary solutions. This multi-provider approach differentiates AWS from competitors focused on exclusive partnerships.

Recent AI Agent innovations promise to transform enterprise business models, though specific applications remain emerging. Partnerships with Hugging Face enable efficient model training and deployment on AWS infrastructure, cementing Amazon’s role as infrastructure backbone for GenAI development.

Amazon’s market dominance creates unique leverage. The European Parliament’s adoption of Anthropic’s Claude model occurred partly because existing AWS procurement agreements limited model selection—a clear demonstration of infrastructure control translating to market influence.

Anthropic: The Safety-Focused Alternative

Anthropic carved a distinct position emphasizing ethical AI development through its Claude series. Strategic partnerships with Google Cloud and Amazon AWS provide infrastructure without sacrificing independence. Amazon’s $8 billion investment included early access provisions for AWS customers, though Anthropic maintains these agreements remain separate commercial decisions.

The company’s focus on AI safety and reliability attracts enterprise clients concerned about responsible deployment, creating differentiation beyond pure performance metrics.

Meta: Open-Source Democratization

Meta pursues an open-source strategy with its LLaMA models, collaborating with Microsoft to integrate them into Azure. This approach aims to democratize AI capabilities while maintaining relevance in enterprise markets through academic partnerships driving GenAI research advancement.

OpenAI: The Catalyst and Current Leader

OpenAI ignited the GenAI race with ChatGPT’s November 2022 launch. The company leads in market mindshare despite intense competition, though its exclusive Microsoft partnership creates both advantages and constraints. The original agreement restricted OpenAI from seeking alternative cloud infrastructure, though recent renegotiations granted limited flexibility while maintaining Microsoft’s right of first refusal.

Emerging Players and Regional Champions

European startup Mistral achieved rapid recognition despite regulatory challenges including AI Act compliance costs. Chinese competitors, particularly Deepseek, challenge Western dominance with models that sparked immediate adoption even from competitors. Apple appears to lag, taking a measured approach while rivals aggressively deploy new features.

Infrastructure: The Hidden Battleground

Model performance captures headlines, but infrastructure control determines long-term winners. Three chokepoints create dependency relationships that concentrate market power:

Chip Supply: Nvidia’s Near-Monopoly

Eleven of twelve major GenAI startups use Nvidia chips—A100 or H100 GPUs optimized for training and inference workloads. Nvidia’s 80-95% market share stems from both superior chip design and CUDA software, which developers describe as Nvidia’s “moat” protecting against competition.

Training sophisticated models requires enormous chip clusters. Aleph Alpha used 512 Nvidia A100 GPUs for Luminous Supreme; OpenAI’s GPT-3 reportedly required 10,000 A100 GPUs. This scale creates massive capital requirements and supply constraints.

Nvidia’s value surged 753% since ChatGPT’s launch, reaching $3.44 trillion in June 2025. Operating margins hit 55.5% in 2024, demonstrating pricing power that concerns competition authorities. France’s competition authority investigates potential anti-competitive practices including price fixing, production limits, and client discrimination.

Cloud Services: The Big Three’s Stranglehold

Ten of twelve major GenAI startups depend on Amazon, Google, or Microsoft for AI infrastructure. These companies spent a combined €671.96 billion on land, buildings, and equipment from 2015 to 2024, with accelerating investment since 2020 driven by AI chip procurement and data center expansion.

Training complex models demands scale that only established cloud providers offer. Building independent infrastructure requires either extraordinary wealth (xAI’s Elon Musk leveraged Tesla and Twitter resources) or government support (Hugging Face’s Bloom trained on France’s Jean Zay Public Supercomputer).

The UK competition authority found AI-specialized providers like CoreWeave lack capacity to threaten the Big Three’s position. Meanwhile, dominant providers actively pursue GenAI partnerships, offering discounted multi-year contracts or commercial arrangements trading infrastructure access for model exclusivity.

Microsoft’s original OpenAI agreement provided AI infrastructure in exchange for exclusive rights to sell GPT models via Azure, forbidding OpenAI from seeking alternative providers. Though renegotiated, Microsoft retains first refusal rights—OpenAI can only use other providers if Microsoft declines requested services.

Platform Access: Gatekeepers to Market

Nine of twelve major startups allow their models on Big Tech platforms—Amazon Bedrock, Microsoft Azure, or Google Vertex. These marketplaces connect GenAI developers with enterprise customers, leveraging existing cloud relationships to control distribution.

This creates platform dependency mirroring previous technology shifts. Amazon, Google, and Microsoft use tactics competition authorities identify as lock-in strategies: free cloud credits, expensive switching costs, and technical barriers to multi-cloud deployments. The French Competition Authority notes these practices intensify in AI markets.

Platform control enables gatekeeping power. Microsoft CEO Satya Nadella describes this moment as “another platform shift”—previous shifts allowed Big Tech to impose exploitative conditions on users and extract immense data and financial fees.

Market Entry: Lower Than Expected Barriers

Despite infrastructure concentration, market entry remains surprisingly accessible. Over thirteen GenAI firms achieved unicorn status (valuations exceeding $1 billion). Venture capital investment surged nearly fivefold to €20 billion in 2023, enabling startups to access costly inputs that might otherwise create insurmountable barriers.

Models improve efficiency—becoming smarter while demanding less computational power. Open-source solutions provide non-integrated developers numerous options. New firms with different business models compete head-to-head with established players, sometimes outperforming them in recognized rankings.

However, uncertainty clouds future accessibility. Some European GenAI startups face growth challenges, citing regulatory costs like AI Act compliance. Competition authorities monitor whether inputs will become less accessible as the market matures.

Competition Concerns: Partnerships and Foreclosure Risks

Competition authorities across Europe, the UK, and US investigate three potential concerns:

Partnership Structures

Vertical collaborations between cloud providers and GenAI startups generate efficiencies by providing access to specialized hardware, computing power, and capital. However, if larger partners exercise decisive control or gain privileged/exclusive technology access, these arrangements may harm competition across value chains or dampen potential competition from startups themselves.

European competition analysis suggests partnerships raise fewer concerns when they include: (a) no or limited exclusivity conditions in supply or distribution, and (b) limited privileged access to startups’ valuable technological assets. Many existing partnerships fail these tests.

Integration and Foreclosure

GenAI applications deliver maximum value when integrated with existing services. This integration can boost innovation in adjacent markets and increase competition faced by established players. However, it also creates foreclosure risks through tying, bundling, or self-preferencing practices.

The UK competition authority found Amazon, Google, and Microsoft experienced rapid growth in AI platform usage and revenue from broader cloud offerings. Internal documents reveal these companies view AI model access as tools for attracting cloud customers and selling adjacent services.

Acquisition Patterns

Recent “acqui-hire” transactions demonstrate alternative consolidation strategies. Microsoft and Amazon essentially acquired Inflection AI and Adept AI by poaching employees and purchasing intellectual property, avoiding traditional merger scrutiny while eliminating potential competitors.

Business Model Challenges: The Profitability Problem

Most GenAI startups struggle finding profitable business plans offsetting extremely high production and deployment costs. Aleph Alpha’s CEO stated plainly: “It’s hard to make it make sense economically. It’s not hard to wire a lot of money to Nvidia. Everybody can do that. But it’s hard to build a working business model.”

Tech giants view GenAI differently—not as standalone profitable businesses but as tools strengthening existing models. They don’t require immediate ROI on investments since GenAI reinforces lucrative cloud services and platform ecosystems.

This creates asymmetric competition. Startups need profitable models to survive; tech giants can sustain losses indefinitely while building platform lock-in. By 2026, more software spending will target GenAI-enabled products than traditional software, but whether independent startups capture meaningful revenue shares remains uncertain.

Global Dimension: Nation-State Competition

The AI race extends beyond corporate rivalry into geopolitical competition. The United States and China lead, with China filing the most AI-related patents. Europe pursues regional champions, with France supporting Mistral and Germany backing Aleph Alpha.

States increasingly provide direct support for AI data centers. The United States, France, and Canada announced public support for private AI infrastructure investments. This often accompanies deregulation—US legislators sought 10-year bans on state-level AI regulation, while France enables very large data center development by overriding local administrations and creating environmental rule exemptions.

However, state support for supposed “national champions” may backfire. OpenAI, Mistral, and Cohere—companies benefiting from government backing—remain deeply enmeshed with Big Tech. France’s support for a Microsoft-backed G42 AI data center directly benefits a dominant player. Without breaking dependencies between AI startups and Big Tech, public interventions likely further entrench existing power structures.

Environmental and Social Costs

The AI boom creates substantial environmental impacts rarely disclosed by companies. According to the International Energy Agency, typical AI-focused data centers consume electricity equivalent to 100,000 households, with the largest under construction consuming 20 times more.

Beyond Fossil Fuels warns new European data centers may threaten energy transitions by increasing fossil fuel consumption or consuming renewable energy needed for decarbonizing other sectors. Research shows AI companies generally fail disclosing environmental impacts and resource consumption, with transparency actually decreasing since ChatGPT’s launch.

Data workers labeling content, cleaning datasets, and testing models face exploitation despite their crucial role. Workers, especially in Global South countries, report poor conditions with minimal protections and low pay. Amazon pioneered this model with Mechanical Turk’s 2005 launch; Meta recently purchased 49% of controversial AI crowdwork platform Scale AI.

Predicting ChatGPT’s Path to 1 Billion Weekly Users

ChatGPT became one of the fastest-growing consumer applications in history. While exact current user numbers aren’t provided in reference materials, the trajectory toward 1 billion weekly users depends on several factors:

Growth Rate Assumptions: If ChatGPT maintains enterprise adoption momentum while expanding into education, government, and healthcare sectors, coupled with continued consumer growth in emerging markets, it could reach 1 billion weekly users by late 2026 or early 2027.

Accelerating Factors: Integration into Microsoft 365 suite, API adoption by third-party developers, and emerging market smartphone penetration could accelerate this timeline.

Limiting Factors: Competition from Google Gemini, Claude, and regional alternatives, regulatory restrictions in certain markets, and the transition from novelty to utility tool may slow growth.

Most Likely Scenario: Given current adoption patterns and market saturation dynamics, ChatGPT will likely achieve 1 billion weekly users sometime in 2027, approximately 4-5 years after its November 2022 launch.

What Success Requires

The GenAI race evolved beyond model benchmark competitions. Success now demands:

Practical Business Outcomes: Providers must deliver real results tied to mission-critical initiatives rather than functional, use-case-oriented AI. Product leaders need to integrate targeted business outcomes into engineering, marketing, and implementation.

Strategic Integration: Models must seamlessly embed into existing enterprise workflows. Standalone tools, regardless of sophistication, lose to integrated solutions delivering immediate value.

Specialized Solutions: Generic models face displacement by specialized, secure, adaptable tools tailored to specific industries and use cases.

Value Chain Control: Companies controlling infrastructure, from chips through platforms, maintain advantages over pure model developers.

Competition Authority Actions Required

Despite expressing concerns, competition authorities haven’t intervened to address Big Tech’s role in AI market evolution. Past platform shifts teach that authorities must not wait until market consolidation completes.

Specific actions needed:

- Cloud Service Investigation: Dominance must be structurally limited through utility-style regulations or structural separation of companies

- Partnership Scrutiny: Investments in smaller companies require investigation not as isolated events but as components of potential anti-competitive strategies

- Interoperability Standards: Dominant players should be forced to implement standards enabling easy switching between clouds

- Supply Chain Monitoring: Nvidia’s chip market dominance and potential anti-competitive practices demand ongoing scrutiny

The Road Ahead: AGI and Beyond

GenAI represents only the beginning. Companies like OpenAI and Anthropic pursue Artificial General Intelligence—systems achieving comprehensive, human-like understanding and reasoning across broad task ranges. AGI introduces both exciting possibilities and significant ethical and technical challenges, emphasizing responsible innovation needs.

The race continues accelerating with ongoing heavy investment in research, acquisitions, and partnerships. As user expectations grow, focus will shift toward developing more specialized, secure, and adaptable GenAI tools.

The ultimate winners should be users—individuals and enterprises gaining access to increasingly powerful tools that transform workflows, productivity, and daily life. However, this outcome depends on maintaining competitive markets, preventing monopolistic control, and ensuring innovations benefit society broadly rather than concentrating power and profits among a few dominant players.

The GenAI model race remains highly competitive and dynamic, but infrastructure dependencies, partnership structures, and platform control create risks that concentrated power will undermine the innovation and accessibility that characterize the market’s current state. How competition authorities, policymakers, and market participants navigate these challenges will determine whether the GenAI revolution truly delivers on its transformative promise.

If you are interested in this topic, we suggest you check our articles:

- Gemini 2.5 Pro Performance Analysis: How It Stacks Against Leading AI Models

- Copilot vs Codeium vs Cursor vs Gemini: The 2025 Coding Assistant Smackdown

- Modern Google AI Tools in the Language Learning Process

Sources: Gartner, Copenhagen Economics, Fabricio Costa @ Medium, Somo

Written by Alius Noreika