Insurance companies across the globe are rapidly integrating artificial intelligence into their daily operations, fundamentally changing how they assess risk, process claims, and interact with customers. This technological shift represents more than incremental improvement—it’s reshaping an industry built on data analysis and risk prediction.

Beyond Traditional Automation

Modern insurance companies deploy AI across multiple business functions, from underwriting to customer service. Unlike previous automation efforts that simply digitized existing processes, today’s AI systems analyze unstructured data, recognize patterns humans might miss, and provide personalized responses that adapt to individual customer needs.

Claims processing exemplifies this transformation. UK insurer Aviva implemented over 80 AI models within its claims division, reducing liability assessment time by 23 days for complex cases and improving claim routing accuracy by 30 percent. The company reported that transforming its motor claims operations saved more than £60 million in 2024 alone.

Customer service has similarly benefited from AI integration. Insurance carriers now deploy 24/7 chatbots that handle routine inquiries while escalating complex issues to human agents. One carrier reported an 11 percent increase in policy purchases after implementing round-the-clock AI-powered customer support. These systems don’t merely provide scripted responses—they analyze customer sentiment and guide conversations toward relevant, personalized solutions.

Enhancing Human Decision-Making

Rather than replacing human workers entirely, AI increasingly serves as an intelligent assistant that augments human capabilities. Underwriters now work alongside virtual assistants that can process applications at unprecedented speed while maintaining accuracy levels that often exceed human-only assessments. These AI systems handle routine cases automatically while flagging complex situations that require human expertise.

In customer communications, AI has demonstrated unexpected capabilities. One insurance company uses artificial intelligence to generate approximately 50,000 claims-related messages daily, with recipients finding these AI-generated communications clearer and more empathetic than traditionally written correspondence.

The technology also enables sophisticated risk modeling and fraud detection. AI systems analyze vast datasets to identify suspicious patterns in claims submissions, helping insurers reduce losses while ensuring legitimate claims receive prompt attention. Commercial property insurers use AI to generate detailed risk assessments and simulate various loss scenarios, providing more accurate pricing and coverage decisions.

Data-Driven Personalization

Insurance companies leverage AI to create highly personalized customer experiences. Machine learning algorithms analyze individual customer data, behavioral patterns, and external factors to recommend appropriate coverage options and pricing structures. This approach moves beyond one-size-fits-all policies toward truly customized insurance products.

One carrier’s implementation of intelligent automation for quote generation and policy sales resulted in 80 percent of transactions moving online, while customer satisfaction scores increased by 36 percentage points. This demonstrates how AI can simultaneously improve operational efficiency and customer experience.

Challenges and Implementation

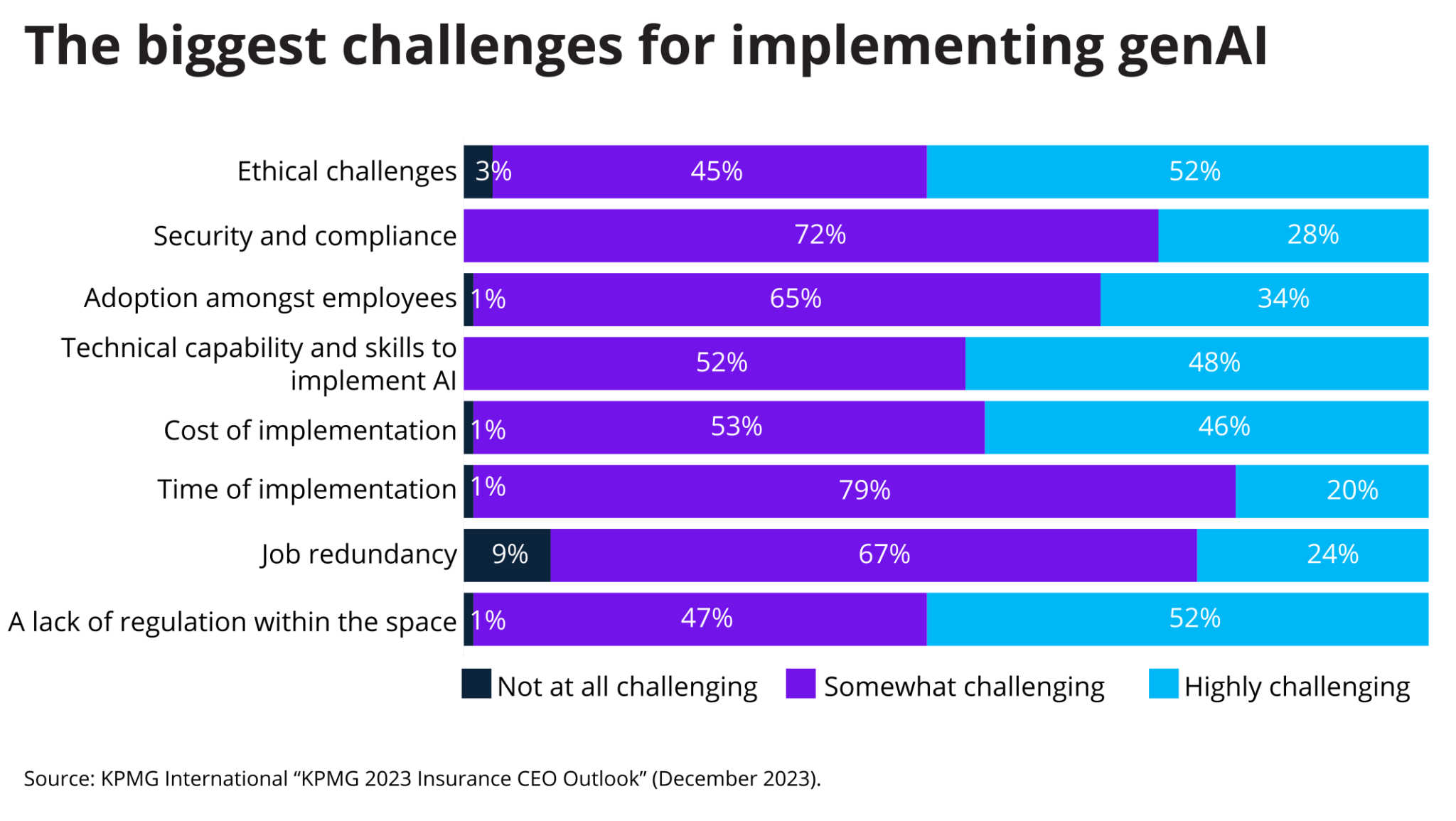

Despite AI’s potential benefits, insurance companies face significant obstacles in implementation. Legacy technology systems often struggle to integrate with modern AI platforms, requiring substantial infrastructure investments. Data quality remains crucial—AI systems require clean, well-organized information to function effectively.

Image source: KPMG

Regulatory concerns also shape AI adoption strategies. Insurance executives report that ethical considerations around AI decision-making and the absence of comprehensive regulatory frameworks represent major challenges. Many industry leaders advocate for AI regulations that parallel climate commitment standards in their rigor and detail.

Looking Forward

The insurance industry’s AI transformation continues accelerating, with companies investing heavily in capabilities that promise to deliver measurable returns within five years. Success requires more than purchasing off-the-shelf solutions—it demands comprehensive workflow restructuring, employee training, and cultural adaptation.

As consumer expectations shift toward instant, personalized service, insurance companies that effectively integrate AI throughout their operations will likely gain substantial competitive advantages. Those that treat AI as merely an efficiency tool, rather than a fundamental business transformation catalyst, risk falling behind competitors who embrace its full potential.

The question for insurance companies is no longer whether to adopt AI, but how quickly and comprehensively they can integrate it into every aspect of their business model.