Key Takeaways

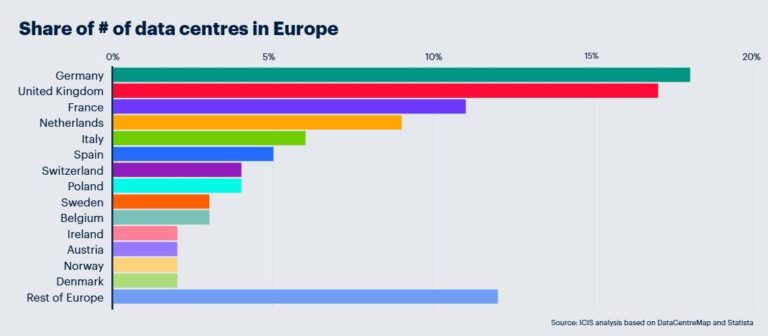

- Germany ranks first in Europe with 529 data centers as of early 2026, representing 4.4% of the global total

- The United Kingdom holds second place with 523 facilities, concentrated primarily around London

- France, the Netherlands, and Italy complete the top five European markets

- The FLAP-D markets (Frankfurt, London, Amsterdam, Paris, Dublin) account for over 45% of European operational capacity

- Europe hosts approximately 3,400 data centers across 45 countries, making it the second-largest regional market after North America

- Power constraints are forcing operators to look beyond traditional hubs toward Nordic countries, Spain, and Portugal

- European data center power demand reached 96 TWh in 2024 and is projected to hit 168 TWh by 2030

Germany maintains its position as Europe’s data center leader in early 2026, hosting 529 facilities that serve as the continent’s primary connectivity hub for Central and Eastern Europe. The United Kingdom follows closely with 523 data centers, while France (322), the Netherlands (298), and Italy (173) round out the top five nations driving European digital infrastructure.

Europe collectively houses approximately 3,400 data centers across 45 countries, representing nearly 30% of global facilities outside the United States. The continent’s data center market reached a valuation of $47.23 billion in 2024 and projections indicate growth to $97.30 billion by 2030, driven primarily by artificial intelligence adoption and expanding cloud services.

Germany: Europe’s Digital Backbone

Frankfurt dominates the German data center market and functions as Europe’s second-largest data center hub after London. The city’s status as a financial center has transformed it into the primary connectivity point for Central and Eastern Europe, largely due to low connectivity costs and the scale of its digital ecosystem.

The DE-CIX IP Exchange in Frankfurt processes peak annual traffic of 18.1 Tbit/s, making it one of the world’s busiest internet exchange points. German data centers consumed approximately 21 TWh of electricity in 2024, representing around 4% of the nation’s total power demand.

Power constraints have emerged as the primary challenge for Frankfurt’s continued expansion. The city’s aging grid infrastructure has forced operators to migrate westward, establishing new facilities 30 to 40 miles from established cloud availability zones. Germany’s Energy Efficiency Act now requires existing data centers to achieve a Power Usage Effectiveness (PUE) of 1.5 by July 2027 and 1.3 by 2030, while new facilities starting operations from 2026 must meet a PUE of 1.2.

United Kingdom: London and Beyond

The United Kingdom’s 523 data centers position it as Europe’s most concentrated market by power capacity, with London alone hosting over 1 GW of operational infrastructure. The London and M25 corridor contains the majority of UK facilities, though Manchester has emerged as a secondary hub attracting increasing investment.

UK power capacity stood at approximately 2,590 MW in 2025, with projections indicating growth to 4,750 MW by 2030. London recorded 43.5 MW of absorption in the first half of 2025, while vacancy rates dropped to an all-time low of 7.6%.

The UK government designated data centers as “critical national infrastructure” in September 2024, ensuring additional protections against cybersecurity threats and operational disruptions. Power availability constraints in West London have pushed new developments further from the city center, with some operators willing to locate up to 40 miles from their preferred availability zones to secure adequate power supply.

France: Paris Dominance and Regional Expansion

France ranks third in Europe with 322 data centers, with Paris and Marseille together commanding a combined capacity of 953 MW. Paris overtook Amsterdam in 2024 as Europe’s third-largest data center market and has attracted demand from sovereign cloud deployments, the emerging sovereign AI segment, and French quantum computing companies.

The Paris metropolitan area accounts for more than 80% of French data center supply and hosts a similar percentage of French unicorn companies valued at over $1 billion. Several of these high-growth companies have migrated from cloud providers to colocation facilities seeking dedicated capacity and lower total cost of ownership.

Brookfield Infrastructure Partners and Data4 announced plans in February 2025 to invest over $20.7 billion in developing AI infrastructure across France over the following five years. Marseille and Lyon are gaining significance as alternatives to Paris, offering greater land availability and more affordable electricity prices.

Regulatory complexity remains a challenge for French market expansion. Operators face extensive permitting requirements across multiple government tiers for new data center developments.

The Netherlands: Amsterdam Under Pressure

The Netherlands hosts 298 data centers, with Amsterdam serving as the nation’s primary hub. However, Amsterdam dropped from Europe’s third to fourth largest data center market after limited new supply additions due to ongoing power constraints.

Amsterdam maintains a planning moratorium on new data centers with IT loads of 70 MW or more, restricting large wholesale deployments. The city’s vacancy rate remains relatively elevated compared to other European hubs, though infrastructure upgrades to local substations scheduled for completion in 2025 and 2026 should enable new project launches.

Dutch data center capacity is projected to reach 1,480 MW by 2030. The majority of facilities operate at Tier III standards, providing the high reliability that international operators demand. Large-scale developments increasingly look toward locations north of Amsterdam or consider alternative European markets, particularly Brussels, which offers available scalable power.

The FLAP-D Markets: Shifting Dynamics

The traditional European data center powerhouses—Frankfurt, London, Amsterdam, Paris, and Dublin (FLAP-D)—collectively maintain over 10.9 GW of total capacity including Milan. These six markets account for more than 45% of European operational capacity and nearly half of the region’s development pipeline.

| Market | Operational Capacity | Vacancy Rate (H1 2025) | Key Challenge |

|---|---|---|---|

| London | 1,189 MW | 7.6% | Power availability in West London |

| Frankfurt | ~700 MW | 5.1% | Grid infrastructure constraints |

| Paris | ~500 MW | 7.7% | Permitting complexity |

| Amsterdam | ~400 MW | Elevated | 70 MW+ moratorium |

| Dublin | ~350 MW | 3.0% | Grid capacity mandates |

Dublin presents a particularly instructive case. Ireland now requires matching dispatchable power for all new data center connections, following concerns that data centers could reach 30% of national electricity demand by 2030. The country’s grid restrictions have effectively created a development moratorium, prompting technology companies to explore alternative locations.

Emerging European Markets

Power and land constraints in traditional hubs have accelerated development in secondary markets across Europe.

Nordic Countries: Sweden, Norway, Finland, and Denmark are attracting substantial investment driven by cool climates that enable extensive free cooling (up to 95% of the time), abundant renewable energy from hydropower and wind, and favorable electricity prices. The Brookfield AI Data Center project in Stockholm represents one of Europe’s largest infrastructure investments at up to $10 billion for 750 MW of IT load capacity.

Iberian Peninsula: Spain and Portugal are experiencing rapid growth. Microsoft announced a data center campus in Zaragoza valued at €2.9 billion, while the Start Campus SIN01 facility in Portugal nearly doubled the country’s total data center capacity when it opened in April 2025.

Italy: Microsoft committed $4.8 billion to enhance AI and cloud infrastructure in northern Italy. Milan serves as the primary hub, connecting Southern Europe, while Rome and Turin are emerging as secondary markets.

Central and Eastern Europe: Poland (144 data centers), Austria, and Czechia are drawing attention from hyperscale operators including Google, Meta, and Microsoft. Warsaw and Vienna are expected to grow substantially as operators seek alternatives to congested Western European markets.

European Data Center Rankings: Complete Overview

| Rank | Country | Data Centers | Share of European Total |

|---|---|---|---|

| 1 | Germany | 529 | 15.7% |

| 2 | United Kingdom | 523 | 15.6% |

| 3 | France | 322 | 9.6% |

| 4 | Netherlands | 298 | 8.9% |

| 5 | Italy | 173 | 5.1% |

| 6 | Russia | 251 | 7.5% |

| 7 | Poland | 144 | 4.3% |

| 8 | Spain | 143 | 4.3% |

| 9 | Switzerland | 120 | 3.6% |

| 10 | Sweden | 95 | 2.8% |

Switzerland benefits from political neutrality, stringent data protection regulations, and proximity to major European markets. Zurich and Geneva serve as primary hubs offering high security and reliability. Belgian data centers (79 facilities) are positioned to capture overflow demand from Amsterdam.

Power Demand and Grid Constraints

European data centers consumed approximately 96 TWh of electricity in 2024, representing 3.1% of total European power demand. ICIS projects this will increase to 168 TWh by 2030 and 236 TWh by 2035, raising the sector’s share to 5.7% of total demand.

The International Energy Agency estimates that European data center electricity consumption will grow by 45 TWh (70%) by 2030. Germany currently leads with data center loads of 4.26 GW, followed by the UK at 3.69 GW and France at 1.72 GW.

| Country | 2024 Power Demand | Share of National Demand |

|---|---|---|

| Germany | ~21 TWh | ~4% |

| United Kingdom | ~13 TWh | ~3.5% |

| France | ~11 TWh | ~3% |

| Netherlands | ~7 TWh | ~7% |

| Ireland | ~5 TWh | ~18% |

Grid congestion has become the primary constraint on European data center expansion. Developers in traditional hubs face connection delays extending to 2030 or later. CyrusOne partnered with E.ON to develop 61 MW of on-site power generation in Frankfurt, exemplifying the industry shift toward self-generation to overcome grid limitations.

AI and Hyperscale Driving Growth

Artificial intelligence workloads are fundamentally altering European data center requirements. AI model training demands continuous high-power loads, while inference workloads create variable demand patterns that existing infrastructure struggles to accommodate.

The average ChatGPT query requires approximately 10 times more electricity to process than a traditional search query. As AI applications expand, operators are rapidly adopting liquid cooling systems to manage the increased heat output from high-density GPU deployments.

Hyperscale operators—particularly Amazon Web Services, Google, Microsoft, and Meta—account for 70-75% of annual market take-up in major European markets. These companies are increasingly purchasing land for self-built facilities to supplement leased colocation space, particularly for AI-specific infrastructure.

The European Commission’s AI Continent Action Plan, released in April 2025, established a goal of tripling data center capacity within five to seven years. Current forecasts suggest the EU may achieve a doubling rather than tripling of capacity by 2030, constrained by grid access and power procurement challenges.

Sustainability and Regulatory Environment

European data centers face increasingly stringent sustainability requirements. The Climate Neutral Data Centre Pact has established annual PUE targets of 1.3 to 1.4 for new facilities by 2025 and existing facilities by 2030.

District heating programs are expanding across Europe, with data center operators supplying waste heat to nearby buildings and communities. In April 2025, atNorth entered a heat-reuse agreement with Finnish retailer Kesko Corporation to supply waste heat from its Espoo data center, reducing the store’s heating emissions by over 200 tons of CO2 annually.

Operators are transitioning backup power systems from diesel to hydrotreated vegetable oil (HVO), reducing net CO2 emissions by over 90%. Amazon signed power purchase agreements in Greece in November 2024 for over 44.4 MW of renewable energy from wind farms.

The European Commission is developing a data center energy efficiency package scheduled for early 2026, which will introduce a labeling system covering energy use, water consumption, and renewable energy adoption.

Market Outlook

The European data center market is experiencing a structural shift. Traditional FLAP-D markets will maintain their importance as connectivity hubs, but their share of new development is declining as power and land constraints force operators toward alternative locations.

Markets to watch in 2026 and beyond include Madrid, Berlin, Lisbon, Milan, Oslo, and Helsinki. Each offers combinations of available power, land, favorable climates, or renewable energy access that established hubs increasingly lack.

Investment continues to pour into European infrastructure despite constraints. The total EMEA data center pipeline reached 24.4 GW by mid-2025, reflecting 43% annual growth. London maintains the largest pipeline at 1,678 MW, while Lisbon advanced from an emerging to an established market following the 1.2 GW Start Campus development.

For organizations planning European data center deployments, the choice of location increasingly depends on power availability timelines rather than traditional factors like proximity to end users. Operators capable of bringing their own power generation or securing renewable energy contracts will find the most favorable terms in emerging markets seeking to establish themselves as viable alternatives to congested traditional hubs.

If you are interested in this topic, we suggest you check our articles:

- OpenAI’s Infrastructure Push: Building a Self-Hosted AI Empire

- 5 Biggest AI Financial Investments in 2025

- How Much Electrical Power Does AI Require?

Sources: ICIS, CBRE, Research and Markets, Venture Capitalist, Data Centre Magazine

Written by Alius Noreika